Investing in Kuala Lumpur Real Estate

Malaysia real estate market is an open one which welcomes foreign investors. Financing can be easily obtained within the country for most nationalities. While each state may have different concession and foreigner state levy, Kuala Lumpur stands out from the rest as it cost around RM 1,000 against RM 20,000 or 2% of property price (whichever is higher) in the state of Johor.

In Kuala Lumpur, a foreigner can only purchase an individual or strata-titled property valued above RM 1 million. Condominiums remain the most popular choice as there are lower maintenance costs and include facilities.

If you are buying a property from a developer, this is commonly known as ‘new launch’. Resale properties are known as ‘sub-sale’.

Foreigners who choose to buy sub-sale are normally those who intend to reside in Malaysia and need a place within the next few months. Investors who prefer the sub-sale market will probably need to be more experienced as price and ownership data is not readily available. You will need to engage real estate negotiators and solicitors whom are trustworthy and professional to assist you with the transaction. If you need a reference, please contact us.

NOTE : The sales and purchase agreement for sub-sale property is not in a standard format. The transaction costs may also be higher than new launches. Do engage professionals to assist you if you are not familiar with the financing options. Sub-sale may offer more flexibility but financing may also be limited.

In general, foreigners would prefer to purchase property through a reputable developer. There are several reasons for this :

- Lower Transaction Cost due to discounts, rebates, rental guarantee packages, absorption of legal fees and stamp duties etc.

- Sales and Purchase agreements are usually standardised and based on the Housing Development Act

- Lower downpayment required in some projects

- Higher valuation by banks for uncompleted projects

- Two years defects liability period that will follow after date of vacant possession

- You typically make small downpayments for each instalment if you are leveraging until vacant possession. By which time, your rental income may subsidise part or all of the monthly instalment

- Some developers may also absorb maintenance fees for a defined period of time

- Avoid any high refurbishment cost or unknown defects which cannot be visible detected during the short viewing

NOTE : Please check with the real estate negotiators on the various sales packages. It will vary between various projects.

On the Road to Recovery

On 10th May 2018, the world watched as Malaysia underwent a peaceful transition from a government which held power for the last six decades. It would probably be an understatement that such a significant event was taken for granted.

Military junta were not uncommon in South-East Asia and you only need to look across its borders to find countries still struggling for political freedom.

As the media focus on the juicier news of court cases involving the 1MDB scandals, Malaysia, now led by its former premier Tun Mahathir Mohamad continues on its road to recovery.

Across the border, some may debate on his flip-flopping of policies related to the water treaties and High Speed Rail project. Others point towards his scrutiny of housing developments involving Chinese developers.

The intent of such drastic measures point towards prudency in fiscal expenditure. Its beneficiaries would be the rakyats and foreign investors with vested interest.

Malaysia Economy and Historical Pricing

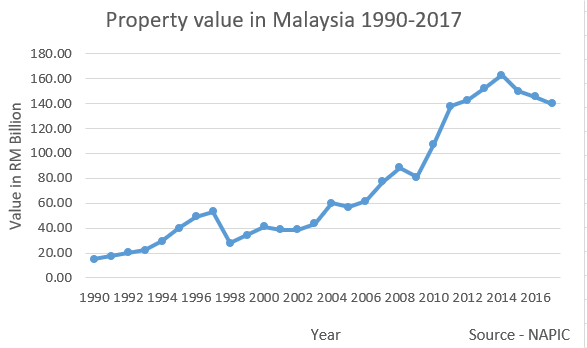

Typically, most foreign investors are concerned with how the Malaysia economy is doing and whether property values will increase over time. The charts below will indicate a consistent rise in property value over the last 17 years.

Real Estate is essentially a long term asset that will continue to appreciate over time provided the country or city is embracing economic progress. Malaysia’s annual GDP growth is likely to hover around 4.5% for 2018.

Currency Risk

Another concern for a foreign investor would be currency risk. Against the Sing Dollar, there was stability over the last two years. In 2015, the fall of Ringgit was largely due to the discovery of 1MDB scandal, the fall in oil prices and devaluation of the yuan. This risk will always be prevalent for investment in foreign countries and largely depends on the FOREX market.

Perhaps one of the ways to hedge against currency risk is to keep your profits in Ringgit. Malaysia was voted by international living.com as the fifth best place to retire in 2018. Consider yourself subscribing to the ten years VISA via the Malaysia my Second Home (MM2H) program and start investing early for your retirement.